MORTGAGE BANKING

THE WAY YOU WANT IT

Our founders envisioned a company second to none. United Mortgage has been recognized as one of the fastest-growing mortgage companies in America by Inc. Magazine. With an exceptional program for mortgage bankers, we strive to continue to be at the forefront of the mortgage industry.

YOU DESERVE MORE

MORE money support freedom flexibility

People are at the heart of our business. United Mortgage believes mortgage bankers can be most successful when they also love their lifestyle. So, how do we do it? How do we create a framework of success for mortgage bankers and give them a lifestyle they love? Simply put United Mortgage provides an unparalleled commission structure and the flexibility, tools, resources, and support to live the life you want to live.

COMPENSATION

United Mortgage offers industry-leading compensation that rewards experience. With unparalleled support, you can focus on what you do best. The opportunities are endless.

SUPPORT

We are passionate about your success and offer a full-service, friendly team to provide the support you need to thrive: Loan processing, marketing, IT, accounting and more.

PRODUCTS

Having a vast array of mortgage solutions available for your clients is key to your success. UM offers numerous loan types to suit a variety of needs and goals, and the list is always growing.

MARKETING

From a CRM, to capture and manage relationships, to a dedicated website and marketing tools you have everything you need to set yourself apart from the competition.

WHY UNITED?

United Mortgage meets the needs of today’s modern mortgage banker in a unique way. Mortgage bankers across the Midwest are discovering the benefits of keeping more of what they earn, while having the freedom to work the way that is best for their business and their lifestyle.

From day one, you begin earning a flat commission regardless of loan volume and have access to our full company benefits, including Medical, Dental, Vision, Life, Retirement and Employee Assistance plans.

OUR

PAST

In 2007, our Founders recognized the need for a dramatic change in mortgage banking so they set out to create a mortgage company unlike any other. Offering more freedom, more money, and all-inclusive support, United Mortgage is changing the standard for mortgage bankers.

THE

PRESENT

Recognized as one of the fastest-growing mortgage companies in America, United Mortgage is the future of the mortgage industry. We unite people with possibilities by creating the greatest lifestyle opportunities for mortgage bankers and the best loan experiences for those they serve.

YOUR

FUTURE

United Mortgage provides the framework for mortgage bankers to love their lifestyle through an unparalleled commission structure, flexibility, tools, resources, and support. We also understand the importance of being transparent, finding the best solutions, being accessible, and providing reliable, consistent communication with the clients and referral partners with which we work.

WHY JOIN UNITED?

We’re Changing the Way Mortgage Banking Gets Done

At United Mortgage, our focus is on you and growing your business. As your success advocates, we make it a priority to provide the best technology solutions for you to conveniently and efficiently conduct business.

LOAN ORIGINATION TECHNOLOGY

- Fully integrated Encompass® LOS with market-leading compliance tools

- Real-time pricing engine

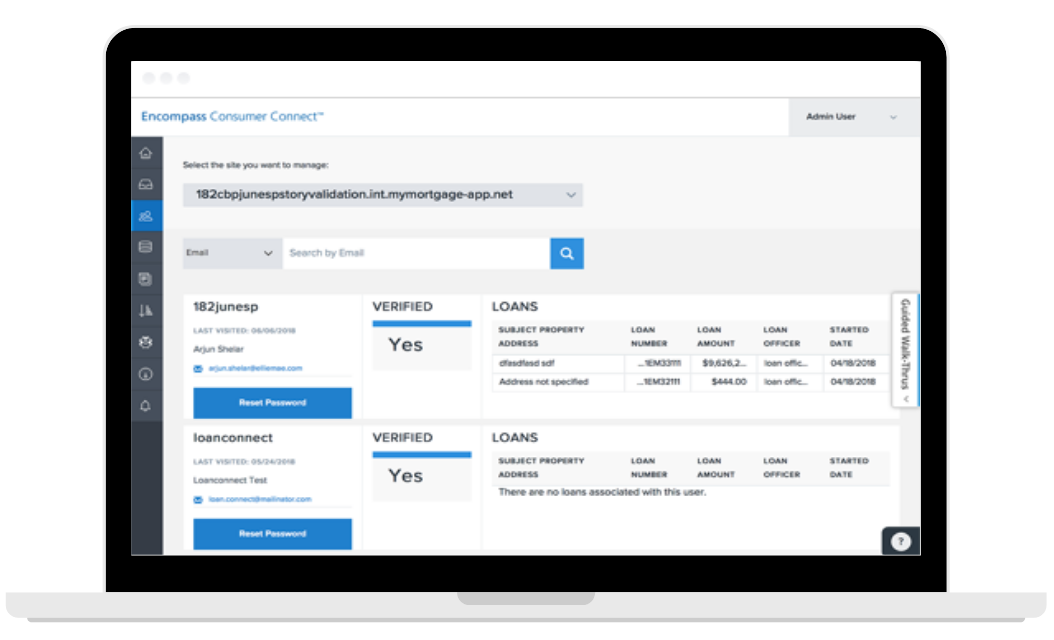

- Encompass Loan Officer Connect™

CONSUMER INTERFACE

- Secure borrower document upload portal with electronic signatures

- Real-time status updates throughout the loan process for all parties involved

Manage your client base and marketing efforts through our comprehensive CRM (Customer Relationship Management), Mortgage Returns by Ellie Mae. Keeping in touch with clients and referral partners has never been easier!

CRM

- Automated email marketing

- A vast library of turn-key direct and digital campaigns

- Email marketing templates and video email marketing integrations

Personalized Webpage

- Personal domain, photo, contact info and customizable biography

- Cloud-based application process with secure Encompass® integration

- Mortgage calculator, tools and resources for your clients and referral partners

- Mobile responsive – viewable on desktops, tablets and smartphone

United Mortgage offers a wide range of loan products to suit your client’s needs.

-

-

- Conventional

- VA

- USDA

- Jumbo

- One-Time Conforming Construction Loan

- One-Time Jumbo Construction Loan

- VA Renovation Loan

- FHA 203K

- Non-QM Products

- Portfolio Product Line

- Reverse Mortgage

- Second Mortgage

- Lower Credit Programs for FHA/VA

-

- Tools and resources for all structures and skill levels

- HR, Marketing and IT supoport

- Technology that boosts your productivity

United Mortgage is a purchase-focused company. We understand the importance of being transparent, finding the best solutions, being accessible and providing reliable, consistent communication. We know that closing on-time is essential. In fact, we’re one of the only mortgage companies to guarantee on-time closing. Our full-service back-office supports our mortgage bankers to ensure it for each and every loan.

At United Mortgage, our focus is on you and growing your business. As your success advocates, we make it a priority to provide the best technology solutions for you to conveniently and efficiently conduct business.

LOAN ORIGINATION TECHNOLOGY

- Fully integrated Encompass® LOS with market-leading compliance tools

- Real-time pricing engine

- Encompass Loan Officer Connect™

CONSUMER INTERFACE

- Secure borrower document upload portal with electronic signatures

- Real-time status updates throughout the loan process for all parties involved

Manage your client base and marketing efforts through our comprehensive CRM (Customer Relationship Management), Mortgage Returns by Ellie Mae. Keeping in touch with clients and referral partners has never been easier!

CRM

- Automated email marketing

- A vast library of turn-key direct and digital campaigns

- Email marketing templates and video email marketing integrations

Personalized Webpage

- Personal domain, photo, contact info and customizable biography

- Cloud-based application process with secure Encompass® integration

- Mortgage calculator, tools and resources for your clients and referral partners

- Mobile responsive – viewable on desktops, tablets and smartphone

United Mortgage offers a wide range of loan products to suit your client’s needs.

-

-

- Conventional

- VA

- USDA

- Jumbo

- One-Time Conforming Construction Loan

- One-Time Jumbo Construction Loan

- VA Renovation Loan

- FHA 203K

- Non-QM Products

- Portfolio Product Line

- Reverse Mortgage

- Second Mortgage

- Lower Credit Programs for FHA/VA

-

- Tools and resources for all structures and skill levels

- HR, Marketing and IT supoport

- Technology that boosts your productivity

United Mortgage is a purchase-focused company. We understand the importance of being transparent, finding the best solutions, being accessible and providing reliable, consistent communication. We know that closing on-time is essential. In fact, we’re one of the only mortgage companies to guarantee on-time closing. Our full-service back-office supports our mortgage bankers to ensure it for each and every loan.

You Deserve More

YOU DESERVE MORE

United Mortgage’s unparalleled compensation program goes far beyond the industry standard. From day one, you begin earning a flat commission regardless of loan volume (no commission tiers). As a team member of United Mortgage, you will have access to our full company benefits, including Medical, Dental, Vision, Life, Retirement, and Employee Assistance Plans.

In addition, the program enables you to earn income not only from your personal commission but also on a residual basis through the on-boarding of other mortgage bankers. Contact us to learn more about our referral program.

Uniting

People with Possibilities

Get in Touch

HQ | 9393 W 110th St, #350, Overland Park, KS 66210

BY APPT ONLY | 1705 Baltimore Avenue, Suite 200, Kansas City, MO 64108

888-220-1130